In the grueling factories and mills of the late 19th and early 20th centuries, our Ethnic American forbearers—Irish fleeing the Great Famine, Germans escaping political turmoil, Italians and Poles arriving in search of opportunity—endured long hours, dangerous conditions, and meager wages to build lives under the promise of the Naturalization Act of 1790. This act welcomed free white persons of good character, allowing these waves of European immigrants to assimilate, become citizens, and contribute to the republic’s growth. They sacrificed health, family time, and often their lives in industrial accidents to secure a prosperous future for their descendants. Yet on January 10, 2026, I watch in fury as the Federal Reserve (Fed) and Internal Revenue Service (IRS)—unconstitutional creations of 1913—extract trillions from Ethnic American families, funneling the proceeds into policies that accelerate our demographic replacement. Hundreds of billions annually support unchecked immigration, corporate exploitation of cheap foreign labor, and global handouts that undermine the very posterity those ancestors fought to establish. This is not mere mismanagement; it is a deliberate betrayal of the founding covenant, turning our inherited republic into an economic mechanism for our own erasure.

I am filled with moral outrage, as every Ethnic American whose lineage traces back to those qualifying under the 1790 Act should be. In this chapter of The Great American Displacement, I expose the Fed and IRS as the fiscal engines driving this engineered dilution, funding internal scams and international grifts that prioritize outsiders over our people. This builds directly on the series’ examination of cultural, institutional, and policy betrayals, revealing how the money machine sustains the invasion that threatens our heritage. Armed with this truth, we must demand accountability before the legacy of those hard-working immigrants is forever lost.

The Shadowy Birth of the Fed: A Central Bank Cartel Usurping Ethnic American Sovereignty

The Fed’s origins trace to the Federal Reserve Act of 1913, a secretive handover of monetary power to private bankers in direct violation of the Constitution. As one pointed reminder states: “Congress alone had the power to coin Money, and regulate the Value thereof.” Article I, Section 8, clause 5: ‘.'” No constitutional basis exists for delegating this authority to a cartel of financiers, yet elites like J.P. Morgan and Paul Warburg orchestrated financial panics to justify their control. President Woodrow Wilson signed it into law, later expressing regret over surrendering sovereignty.

This act enabled unchecked inflation and debt creation, eroding the purchasing power of Ethnic American workers, who built America’s industrial might. As of early January 2026, the Fed’s balance sheet stands at approximately $6.57 trillion (per the latest H.4.1 release), down from pandemic peaks but still massively inflated through quantitative easing that favors Wall Street over Main Street.

The human cost is profound. Consider a typical third-generation Ethnic American family, like Polish or Italian descendants in industrial heartlands, who saved diligently through economic hardships. Today, they face relentless erosion of their earnings. The official inflation for late 2025 was around 2.7% (all items, 12 months ending November), but food prices have seen sharper cumulative rises. From December 2019 to May 2025, food prices were up 29.5%, with ongoing pressures from supply issues and policy factors driving persistent increases. Specific items highlight the pain: ground beef and orange juice spikes of 15-21% in recent periods, as tracked by various analyses. Housing, essential for family stability, has seen even steeper climbs—the FHFA House Price Index rose to around 436-437 points by late 2025 (from base levels), reflecting cumulative increases of over 50% in many markets since 2020, pricing out young Ethnic American families from starter homes while subsidizing urban influxes.

This devaluation hits hardest in manufacturing and construction, sectors where Ethnic Americans historically predominated, now undercut by imported low-wage labor subsidized indirectly through Fed policies. Quantitative easing has widened wealth gaps, as Brookings Institution studies confirm, benefiting asset holders while squeezing wage earners. In recent years, new debt issuance supported programs accelerating demographic shifts, betraying the covenant those forebears upheld.

Sound Money: The Only True Antidote to the Fed’s Debt Machine

Sound money is currency with intrinsic, stable value that cannot be arbitrarily created or debased—typically gold and silver coins, or assets backed by them—serving as a reliable store of wealth, medium of exchange, and unit of account without relying on government promises or endless printing.

The Federal Reserve’s greatest crime is not just its existence, but the fiat currency it imposes: Federal Reserve Notes that are mere debt instruments, promises to pay backed only by faith in a system that creates more obligations out of thin air. Every dollar printed through quantitative easing or open-market operations is not real wealth; it is new debt that must ultimately be repaid by the productive labor and savings of Ethnic Americans. A bill of currency is debt—it is owed money, not money itself. Printing more fiat bills is as detrimental as the Fed itself, acting as a hidden tax that erodes purchasing power, punishes savers, and enables the very fiscal excesses funding our displacement: endless welfare, immigration subsidies, and global grifts.

This is the antithesis of what the founders intended. The Constitution grants Congress the power “To coin Money, regulate the Value thereof” (Article I, Section 8, Clause 5), implying tangible, metallic currency. The founders—Thomas Jefferson, James Madison, John Adams, George Washington, and Alexander Hamilton—advocated gold and silver coins as the nation’s money, viewing unbacked paper as prone to abuse, inflation, and tyranny. Jefferson called paper money “poverty… only the ghost of money,” warning it leads to fraud and injustice. Hamilton cautioned that unfunded paper would produce “great mischiefs in the long run.” Madison deemed it unjust, as it affects property rights like land seizure.

The Founders enshrined protections for sound money in Article I, Section 10, barring States from making anything but gold and silver coin legal tender.

The Coinage Act of 1792, signed by Washington, established a bimetallic standard: the U.S. dollar defined by specific weights of pure gold (24.75 grains) or silver (371.25 grains), creating “Constitutional money” with intrinsic value. This sound money system constrained government spending, protected citizens from debasement, and ensured currency retained purchasing power over generations.

Under sound money, the Fed’s ability to finance trillion-dollar schemes—mass immigration, foreign aid, and welfare empires—would be impossible without direct taxation or borrowing at honest rates. No more inflating away Ethnic American savings to subsidize replacement. Returning to gold and silver standards (or fully backed assets) would force fiscal discipline, shield our wealth from devaluation, and starve the beast that betrays our posterity. Anything less perpetuates the cycle of theft. The founders knew: without sound money, freedom cannot endure. We must reclaim it to restore the republic they built.

The IRS Inquisition: Extracting Blood Money from Ethnic Americans to Finance Invasion

The IRS, empowered by the 16th Amendment in 1913, enforces this plunder. Historical controversies surround its ratification—critics like William Benson in The Law That Never Was documented procedural irregularities, missing signatures, and wording discrepancies across states, suggesting fraud in achieving the required three-fourths approval. Though courts have rejected these as frivolous (e.g., United States v. Benson, 2009), the direct tax without apportionment contradicts founders’ protections against arbitrary extraction.

With a massive bureaucracy, the IRS collected trillions in recent years, disproportionately from middle-class Ethnic Americans via income and payroll taxes. These funds enable displacement: lax enforcement swelled the undocumented population to estimates that have been fudged for decades—we were told 11-15 million through the 80s and 90s, yet Florida AG Ashley Moody recently highlighted over 10 million pouring in just under the Biden administration alone, per her January 8, 2025 statement, while figures like JD Vance on Fox News peg it at 30 million, and candidates like French (TX) and Parker (Senate hopeful) claim over 60 million, underscoring how official numbers are manipulated to downplay the invasion. Programs like the 2025 “One Big Beautiful Bill Act” allocated billions for immigration-related costs amid ongoing influxes (per Migration Policy Institute).

The net fiscal burden of illegal immigration remains staggering. Recent analyses, including CBO reports on the 2021-2025 surge, confirm net drains, with lifetime costs for recent arrivals exceeding $1 trillion per Manhattan Institute 2025 update.

Human stories illustrate the pain: Laid-off Ethnic American workers in Ohio or Pennsylvania factories—descendants of early 20th century arrivals—compete with subsidized undocumented later; I wrote about it in Part VII (Blue Collar Immigration). Corporate examples abound: Walmart’s history includes fines for exploiting undocumented workers (e.g., $11 million in 2005), and recent 2025 actions firing employees post-rulings. Hyundai faced 2024-2025 scrutiny for child labor in Alabama supply chains and a major 2025 ICE raid detaining hundreds on improper visas at a Georgia plant.

Scandals compound the outrage. The Minnesota fraud cases, involving Somali immigrants and programs like child nutrition, housing, and autism services, have seen federal prosecutors estimate losses potentially exceeding $9 billion across multiple schemes (with 92 charged and 62 convicted as of early 2026, per CBS News), amid ongoing probes into billions in federal funds since 2018. This laxity amid massive fraud drains resources from Ethnic American families, and aggressive enforcement now—including 2,000 federal agents deployed per NPR—pushes tensions to the brink of civil war, with fears of unrest as communities clash over resources and accountability.

To quantify:

| Category | Annual Cost to Taxpayers (Latest Est., in billions) | Description | Source Notes |

|---|---|---|---|

| Education for Illegals’ Children | $70 | K-12 costs | CBO Analysis |

| Medical Expenditures | $22 | Uncompensated care, Medicaid | CBO Analysis |

| Welfare Benefits | $11.6 | Food stamps, SSI, etc. | CBO Analysis |

| Law Enforcement & Justice | $20 | Incarceration, policing | CBO Analysis |

| Total Net Cost | $151 | After taxes paid | CBO Analysis |

This domestic hemorrhage pairs with global outflows.

Global Grifts: Tax Dollars Hemorrhaging Abroad While Ethnic Americans Suffer

Ethnic Americans fund international betrayals: Foreign aid for FY2025 totaled around $71.9 billion in disbursements (per Pew Research), with USAID channeling billions to regions fueling migration. This “root causes” aid often fails, as border encounters remain high (per Pew). Social Security ($1.5 trillion annually per CBPP) faces diversions, shortchanging Ethnic American retirees.

In border states, ranchers suffer cartel violence indirectly tied to aid propping up a corrupt regime South of the Border. Ukraine aid and other packages drain resources amid domestic decay, violating founders’ warnings against entanglements. For FY2026, CBO projects international affairs spending around $31 billion in requests (per CBO 2025 Outlook), but with ongoing wars, actual numbers could soar—Ukraine alone received over $60 billion in 2025 packages, Israel $10 billion+, and Central America “root causes” billions that haven’t stemmed the flow. These handouts, financed by Fed debt, inflate our currency while propping up regimes exporting migrants, costing Ethnic Americans trillions in downstream burdens like welfare and crime. The betrayal deepens as our taxes—70-75% paid by non-Hispanic whites per recent analyses—fund globalist agendas that erode our sovereignty, from UN pacts to climate slush funds, all while domestic infrastructure crumbles and veterans go homeless.

The Debt Spiral and Generational Theft: Projecting the Long-Term Assault on Ethnic American Posterity

I cannot ignore the looming catastrophe of escalating national debt and inflation, perpetuated by the Fed-IRS nexus, which enslaves future generations of Ethnic Americans to perpetual servitude while funding their demographic eclipse. As of January 2026, the U.S. national debt surpasses $36 trillion, per U.S. Treasury data, with annual interest payments alone topping $1 trillion—more than defense spending. This debt, inflated by Fed money-printing, is no abstract number; it’s a chain around the necks of our children and grandchildren, descendants of those hardy European immigrants who built this nation without such burdens.

Projecting forward, the Congressional Budget Office (CBO) in its 2025 long-term outlook warns that under current policies, debt as a percentage of GDP could hit 122% by 2035 and balloon to 166% by 2055, driven in part by immigration-related expenditures. A 2024 CBO report on the 2021-2026 immigration surge estimates an additional $1.2 trillion in federal spending over the next decade, including $278 billion directly for benefits to surge populations and their children—costs that Ethnic American taxpayers will shoulder through higher taxes and inflation.

The Manhattan Institute’s 2025 fiscal impact update paints a grim picture: The average unlawful immigrant residing in the U.S. will cost the federal government $225,000 more than they pay in taxes over the next 30 years, factoring in age, education, and public goods. For recent arrivals, lifetime net costs exceed $80,000 per person, aggregating to trillions that divert resources from Ethnic American priorities like infrastructure and education. If unchecked, this could add $20 trillion to the debt over 30 years, per institute projections, while comprehensive reform favoring high-skilled immigrants might stabilize it—but current policies favor low-skilled influxes that exacerbate the spiral.

Inflation compounds this theft. The Fed’s policies have eroded the dollar’s value by over 20% since 2020, per BLS CPI data, hitting Ethnic American savings and wages hardest. Future projections from economists like those at J.P. Morgan in 2025 analyses suggest persistent 3-4% inflation if debt-financed spending continues, further devaluing inheritances. Human impacts are visceral: A young Ethnic American couple in the Midwest, starting a family, faces mortgage rates above 6% due to Fed hikes, while their taxes fund welfare for newcomers who undercut job markets. Stories from Arizona ranchers or Michigan autoworkers echo this—ancestral lands sold off to pay rising costs, opportunities stolen for posterity.

This generational theft betrays the founding covenant, where our ancestors envisioned a republic unencumbered by such debts. CBO scenarios show that without reform, Social Security and Medicare—programs Ethnic Americans paid into—face insolvency by the 2030s, accelerated by demographic shifts. Only a return to sound money can break this generational debt trap; fiat printing merely accelerates the enslavement of our posterity while funding the very demographic eclipse we fight against.

A table of projections underscores the urgency:

| Projection Metric | 2026-2035 Estimate (trillions) | Description | Source Notes |

|---|---|---|---|

| Additional Immigration-Related Spending | $1.2 | Benefits and services for surge populations | CBO Report |

| Net Cost per Unlawful Immigrant (Lifetime) | $0.000225 (per person, aggregated to trillions) | Taxes paid minus benefits received | Manhattan Institute |

| Interest on Debt | $10+ | Annual payments escalating | U.S. Treasury |

| Total Debt Increase from Policies | $20 | Over 30 years without reform | Manhattan Institute |

This spiral demands immediate outrage—our posterity’s freedom hangs in the balance.

The Disproportionate Burden on Ethnic Americans: Net Contributors Funding Their Own Demise

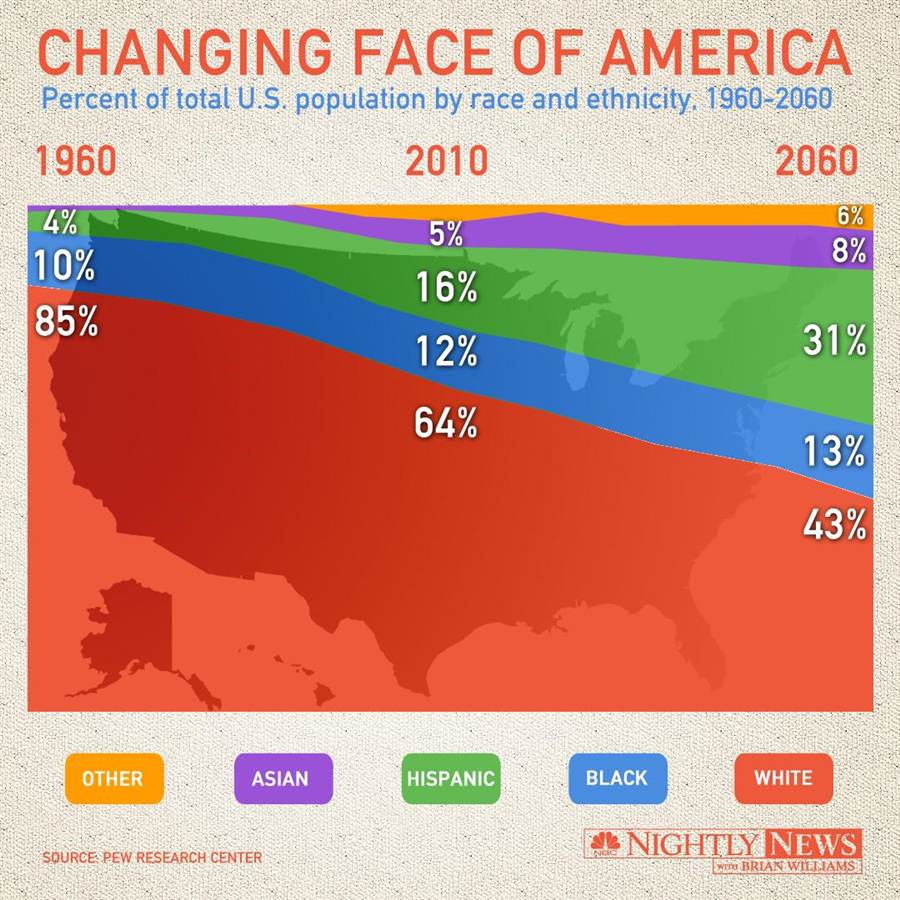

The Fed and IRS not only extract wealth but do so disproportionately from Ethnic Americans, who as net fiscal contributors subsidize their own replacement through programs benefiting net drains, accelerating a demographic transformation that erodes our heritage. Two stark visuals below illustrate this betrayal: one depicting the historic demographic shift from a predominantly Ethnic American (non-Hispanic White) nation in 1960 (85% White) to a projected minority status by 2060 (around 43-45% non-Hispanic White, per updated U.S. Census Bureau projections and related analyses), with Hispanic shares rising dramatically to 27-31%, Black to 13-14%, Asian to 8%, and other groups filling the rest. This engineered change—fueled by mass immigration policies—aligns precisely with the series’ theme of displacement, where our ancestors’ posterity is diluted through fiscal incentives that draw in low-skilled populations at our expense.

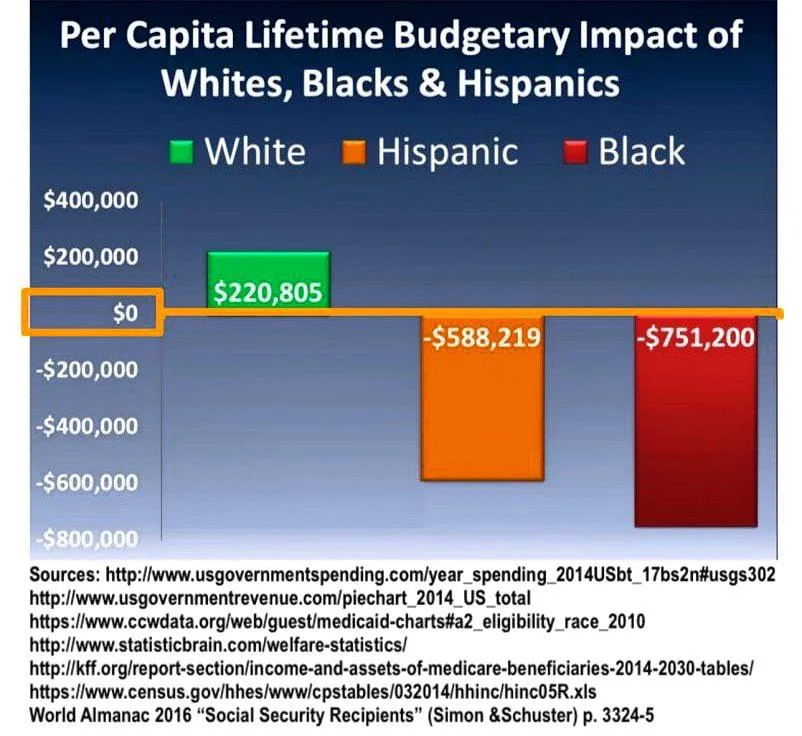

The second chart below exposes the fiscal injustice: it shows lifetime net budgetary impacts where Whites are net contributors (positive $220,805 per capita in older analyses), while Hispanics and Blacks are significant net drains (negative hundreds of thousands). Though this specific chart draws from 2010s-era data (e.g., sources like USGovernmentSpending.com and Census-linked eligibility studies), it echoes persistent patterns. Updated research, such as the Manhattan Institute’s 2025 fiscal impact update, confirms that lower-education and certain demographic groups (including many recent immigrants) impose lifetime net costs—often $80,000+ per unlawful immigrant or more for low-skilled arrivals—while high-skilled (disproportionately from groups like Asians) are positives.

Ethnic Americans—primarily descendants of European immigrants qualifying under the 1790 Act—bear an unfair, disproportionate burden. They pay 70-75% of federal income taxes, per recent data analyses, while representing about 59% of the population—Hispanics (19%) contribute 10-12%, and all other races combined the rest. High-income Ethnic Americans shoulder most of the federal income taxes: the top 1% paid ~40% of individual income taxes in recent years, per IRS data, while lower-income groups (disproportionately non-White) receive more in refundable credits like EITC.

Critically, Ethnic Americans fund the very programs accelerating displacement. Estimates of illegal immigration’s net annual cost hover around $151 billion (after minimal taxes paid), with major burdens in education ($70B), medical ($22B), and welfare—costs largely shouldered by middle- and upper-income taxpayers, who are overwhelmingly Ethnic American. This creates a vicious cycle: our taxes subsidize welfare magnets and low-wage labor that undercut our jobs, while demographic shifts reduce our political and economic influence.

The unfairness is stark—Ethnic Americans, as net contributors, pay 70%+ of taxes, yet see resources diverted to groups that are lifetime net drains. This generational theft erodes our inheritance, forcing us to fund our own replacement. The founding covenant demanded fiscal responsibility to posterity; instead, the Fed-IRS machine enables betrayal.

To visualize this injustice further, consider these representations of the demographic erosion and fiscal imbalance:

These visuals hammer home the urgency: our taxes fuel the shift that diminishes us. The Fed’s inflation devalues the savings of net contributors like Ethnic Americans, while the IRS extracts disproportionately from us to fund global grifts and domestic programs that import replacements, hastening the demographic tide that will submerge our posterity.

Legislative, Judicial, and Institutional Complicity: Coercion, Collusion, and Cowardice in High Places

Congress enables this through bills like the One Big Beautiful Bill Act ($170 billion for immigration), while the Supreme Court upholds Fed structures. DHS parole programs cost billions in welfare (CIS reports). Complicity before lobbies have the ability to betray us more.

| Entity | Role in Complicity | Cost Implication (billions) | Source Notes |

|---|---|---|---|

| Congress | Funding immigration programs | $170 (OBBBA) | NPR |

| Supreme Court | Upholding Fed | Enables massive debt | SCOTUSblog |

| DHS | Parole/welfare | $3 annual | CIS |

| IRS | Lax enforcement | Enables MN fraud (> $9B est.) | CBS News |

Tying to the Series: The Fiscal Thread in the Tapestry of Displacement

This fiscal assault integrates with the series’ themes: The Fed-IRS machine bankrolls welfare draws from Part X: The Immigration Conquest (Parts V–IX United), foreign policies in Part XV: (Foreign Tribute), and institutional hijacks in Parts Part V: (The Illegal Invasion), Part VI: (White Collar Immigration) and Part VII (Blue Collar Immigration). Without it, cultural dilutions couldn’t persist.

A Powerful, Actionable Call to Action

Ethnic Americans, act: Demand audits via Congress.gov, support repeal of the 16th, defund immigration. Join protests, back Audit the Fed, consider 2026 tax revolts per New York Post. Boycott exploiters, preserve heritage—reclaim the covenant now. Demand a return to sound money—gold and silver standards—to dismantle the Fed’s fiat debt machine and protect Ethnic American wealth from inflation-fueled displacement.

A personal note from James Sewell: My soul aches for our betrayed legacy, but ignites with ancestral resolve. Fellow Ethnic Americans, channel this outrage into action; the republic’s fate demands it. Stand, or lose it all.

© James Sewell 2026 – All rights reserved

Pingback:The Ethnic American Library - Ethnic American